Common problem plastered all over financial media outlets such as CNBC.

You’re not on track to save $1,000,000 or whatever magic number the retirement calculator says you must hit to live a comfortable retirement.

As I frequently lament, the only solution the people who write these articles float is more math. If you want to retire with $1,000,000 by 60, 65 or whatever, you must save this much money each month.

You know why this is lame. If I couldn’t hit a number less than that for the past 30 years, how in the hell am I supposed to do it over the next 5 or 10?

My personal solution—

Take what I can save, which will be closer to $100,000 than $1,000,000 and pay cash for a place to live, eliminating my biggest expense and securing an ultra low cost of living.

You can read about how I plan to do this here or how you can do likewise here.

Whether you do it in Europe, the United States, or elsewhere, for my money, this is the #1 route to take if you couldn’t quite save enough for a secure traditional retirement. Getting rid of your housing expense—or keeping it as low as possible—is one of the most critical elements of any Never Retire strategy.

However, for a whole host of reasons this might not work for everyone.

And you still need to address the issue of not having enough money saved to live the rest of your life and live it well.

Let’s say you spend $4,000 a month. That’s $48,000 a year. In this hypothetical, you have a housing payment. We’ll put it somewhere around $1,500-$2,000.

$500,000 takes you just over 10 years at this cost of living.

Real quick—take away the housing expense and $500,000 takes you about 16.5 years. Big difference.

In either scenario—

Social Security doesn’t come up enough in these discussions.

I don’t understand why.

Social Security can be a powerful game changer.

Using my actual Social Security situation—as somebody who makes modest money—alongside the hypothetical that I will have $500,000 saved at age 55, let’s do some math.

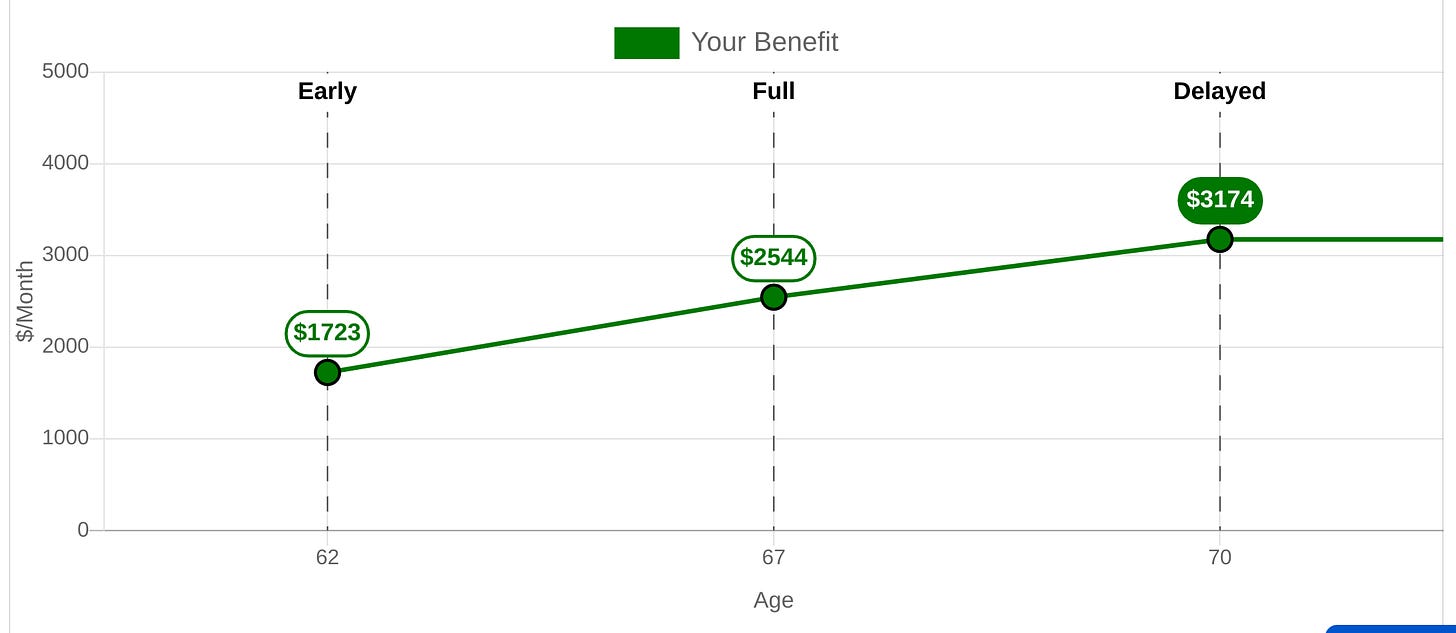

If I decide to collect at age 62, I will get about $1,700 a month. Wait until age 67 and it’s a much more attractive $2,500.

When I hit 55, I’d have to decide to keep working at least a few more years.

If I work until 60, I need to draw that $500,000 down for two years before collecting Social Security. At $48,000 a year (including $1,500 for housing), I’m left with $404,000 at age 62.

At this point, I can start using that $1,700 a month to cover my $1,500 a month housing payment.

This leaves $200 left over each month, which will go towards cost of living.

So, we’re left with $2,300 to cover each month, or $27,600 a year.

$404,000 will take care of this cost of living for 14.5 years. This takes me to 76 years old.

Better, but not going to cut it.

This underscores the importance of acknowledging, embracing, and planning for your Never Retire reality sooner rather than later.

55 is better than 76, but 35 or 45 is better than both.

$1,500 in monthly cash flow in retirement drastically changes these calculations. It means your $500,000 nest egg only has to help cover $800 a month, or $9,600 a year.

$404,000 covers this for 42 years, bringing you to 106 years old.

The sooner you map out a rough sketch with your numbers, the better you can position yourself work-wise.

While the idea of a part-time gig at Home Depot in retirement can actually sound kind of attractive (seriously), being forced into this situation in your 70s doesn’t. Setting up a freelance/remote arrangement—with options and a plan B—as soon as possible should be the preferred course.

You never know. You might end up with more than you need.

Love the article! Gives me some food for thought.

Question: What are your thoughts on pre-paying one's home mortgage, given the recent tax changes to the standard deduction/itemized deduction?

I liked this too. Very interested to hear the answer to the question about mortgage paydown from Iwannabeonthebeach