Never Retire - This Could Be A Solid Housing Situation

An exercise to get the wheels turning as you consider how to situate life's biggest expense

We spend a lot of time discussing housing in the newsletter.

Because it’s one of the most, if not the most important component of just about any Never Retire strategy.

Ideally, as you head into relative old age, you want to find a way to eliminate your housing payment. As a lifelong renters who can’t afford to buy a home where we’d like to live in the United States, my partner and I have four main options to achieve this—or something close to it.

Because there’s so much doom and gloom on housing right now (record rents, skyhigh home prices, a 30-year mortgage rate now more than 7%, absurd monthly payments), I want to keep it positive by doing something I do from time to time—

Highlight a representative opportunity that, in this case, doesn’t require moving to Spain or Italy!

While this specific situation might not work for you, hopefully it gets the wheels turning on how to proceed as you aim to find the floor on your cost of living and craft a not only viable, but attractive and exciting Never Retire strategy.

Before we get into it, please consider upgrading to a paid subscription. It keeps the newsletter going, helps diversify my income streams, and comes at a 20% discount for one year.

115 College Street in Buffalo, NY

I write about Buffalo, particularly the Westside a lot. Because I grew up in Western New York and know the city well. Plus, what has happened and is happening in and around Buffalo’s Elmwood Village is one of the best stories I’ve seen of urban rebirth in the United States.

While Elmwood Village has become less affordable over the years, the neighborhood next door—Grant/Ferry—is a relative bargain as it emerges much the same way as its Westside neighbor has.

Then there’s a neighborhood called Allentown. At the Downtown tip of Elmwood Village, also considered Westside.

In that area, there’s a two-unit building that just went up for sale—

Here’s the Realtor.com listing.

Upstairs is a 3-bedroom, 1-bath

Downstairs is a 2-bedroom, 1-bath

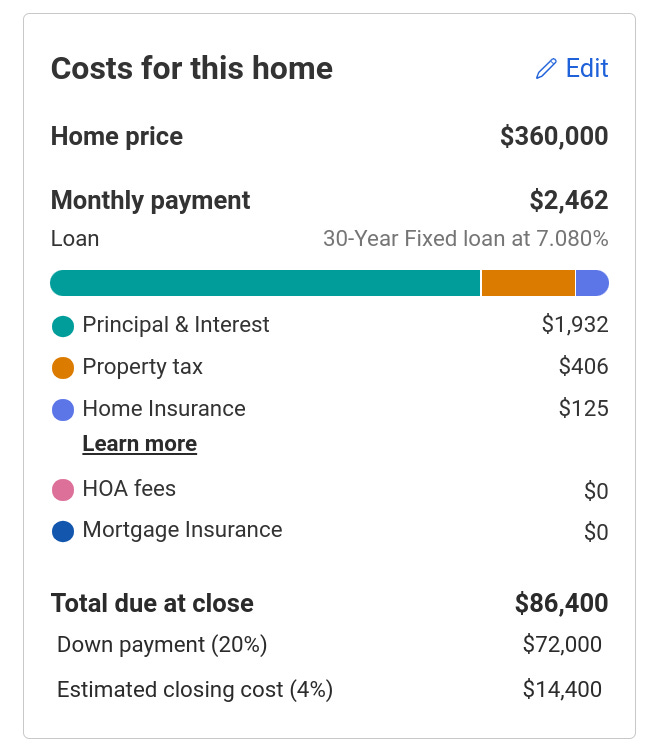

The property is listed for $360,000

With 20% down ($72,000), you’d be on the hook for a $288,000 mortgage.

Here’s how I calculated the $2,462 monthly payment.

Yes, property tax sucks in New York.

Yes, it’s a terrible time to take out a mortgage with the rate on the 30-year just crossing 7%.

Here again, this is just to get the wheels turning.

What areas do you know well where affordable situations you’d actually like to find yourself in exist?

Plus, even in this not-so-favorable environment, this isn’t a horrible deal. In part, because rental prices have soared nationwide, including in Buffalo’s prime neighborhoods.

Based on the searches I ran in and around Allentown, that 3-bedroom unit could fetch comfortably more than $2,000 a month. You can get a premium because you have a two-unit, well-kept, classic Victorian property. This isn’t a typical apartment rental in the area. That said, comparable apartments (in size) there often go for $1,500 to $2,000.

This leaves you with $500 to cover for the rest of your mortgage payment if you choose to live in the beautiful 2-bedroom unit.

Rent them both out and you’ve got an income property with your mortgage more than covered. The excess could go to cover or help cover wherever you currently live.

Certainly not a bad situation overall, particularly if you’re still generating cash flow in relative old age, which we’ll assume you are, given that you’ve made the choice to Never Retire.

Housing—next to the work you do now and in relative old age— is the most important element to consider as you contemplate Never Retire strategies. It might require relocation and/or a significant lifestyle change, but that comes with the challenge we have in front of us to live the lives we wanna live now and for the duration.