Never Retire - The Runaway American Dream?

Question #3 For 2023: Why Do You Hate Home Ownership?

Why do you hate home ownership?

Between my writing on Medium and the Never Retire newsletter, I get this question frequently. In today’s post, I address it, using December 2022 housing market data.

Short answer: I don’t hate home ownership. Quite the contrary.

But first…

While I have made all Never Retire newsletter posts free for January, almost everything goes behind the paywall in February and March. So now is a great time to join as or upgrade to a paid subscriber. Because we have big (and fun) plans for February and March. At the end of today’s post, I quickly summarize what we’ll be doing in less than two weeks!

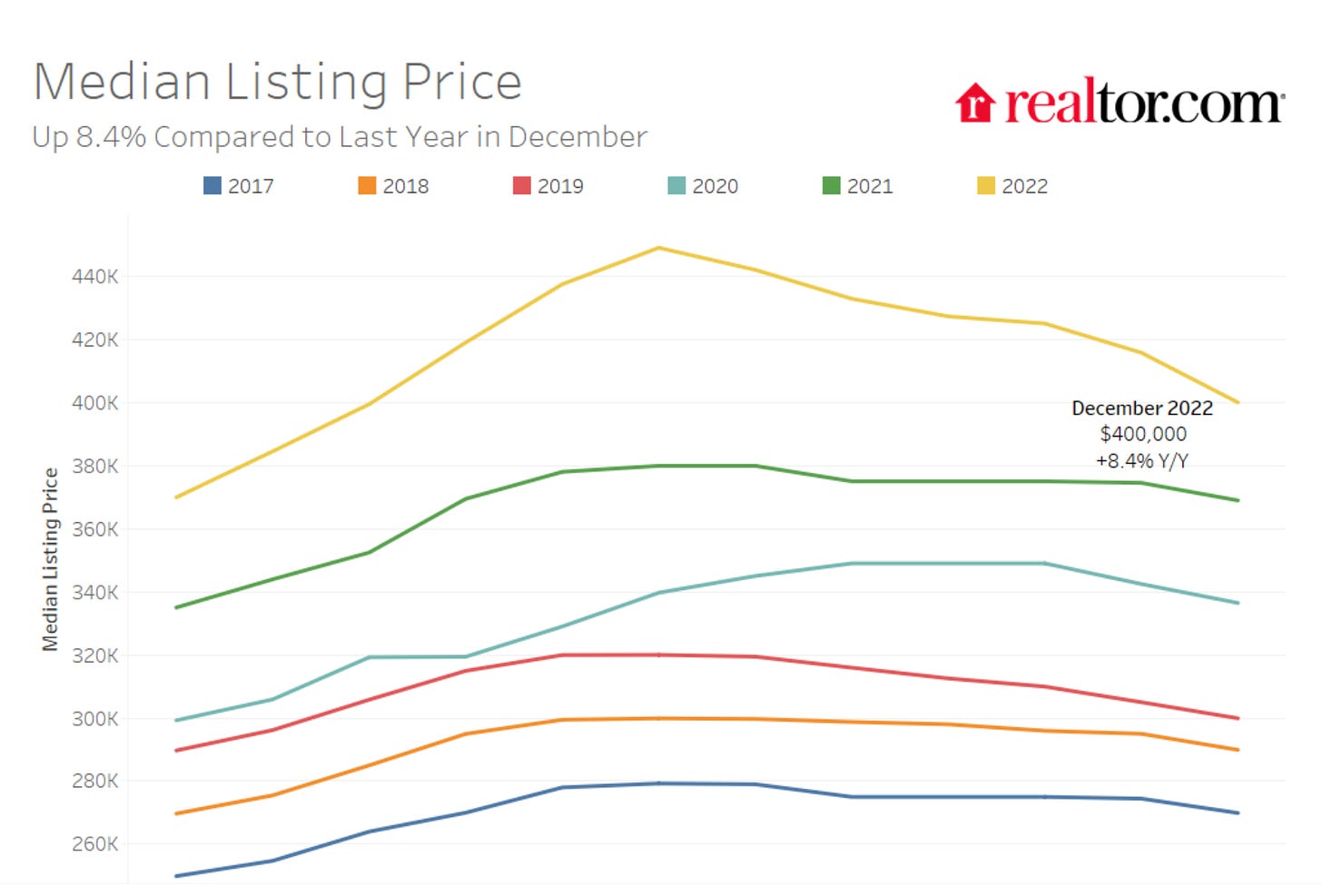

In December, the median list price on a home dropped to $400,000.

If you were to buy a new house today for $400,000, here’s how it would break down financially:

10% down payment: $40,000

$360,000, 30-year mortgage at 6% interest

Monthly payment (before insurance and property tax): $2,158

Monthly payment (with insurance and property tax in CA): $2,857

Six months ago at 7.3% interest, your down payment would have been closer to $45,000 and your monthly payment, before insurance and property tax, would have been $2,777. Include insurance/property tax and you’re looking at ~$3,563 a month.

All big numbers.

First, the big qualifier. We’re talking the national median. You can’t touch anything for less than $500,000 in massive segments of the country. It’s basically impossible in dozens of places.

Second, even a $2,857 monthly payment requires significant earnings. To afford that payment—using the 30% of your income standard, which I am not a big fan of—you would need to make roughly $114,000 a year.

A few observations on that:

I don’t want to put that level of financial pressure on myself. The need to maintain that level of employment to meet my housing obligation. When you factor in maintenance, my housing expense—on the typical home nationally—would be higher than my entire cost of living today.

These numbers tell me that the days of aspiring to home ownership are long gone. Or if you own a home, the days of upgrading are long gone. If you’re a renter, it’s not as attractive of a proposition as it once was to become a homeowner. If you live in a relatively expensive place, it might be next to, if not financially impossible.

There was a time not long ago when—looking at the national average—it made sense to buy a home or move into a new one. For an increasing number of people, this is no longer the case. Especially if you don’t want to stress yourself out over work and money.

That said, if you got in when the getting was good, home ownership then, and as it turns out, now was an excellent move. You’re sitting pretty today with a relatively low or maybe no mortgage payment. At the very least, you might be on track to pay your house off just before you enter relative old age or shortly thereafter. You will have achieved one of the main goals of any Never Retire strategy—no housing payment.

No doubt, I regret not buying an income property in Buffalo, New York when I first considered the possibility 15 or so years ago. The income property situation

wrote about in her Wednesday guest post is truly a fantastic position to be in.That said, if you’re prepared to make a big move, home ownership could still be in the cards. Relatively affordable situations exist in cities such as Buffalo and Pittsburgh. But you have to be willing to move to these places. Same goes for making a move abroad. You must be willing to make a big move and be okay with the housing choices you can comfortably afford in these places.

Will home ownership make you better off financially today and for the duration than you were yesterday?

That’s the question. It’s not a hatred of home ownership. It’s being right place, right time, better for your quality of life and financial condition sensible about it.

Not we’ll eat cup-of-soup for five years, then we’ll be okay. What kind of life is that? Particularly when you can spend those five years living well and saving to set yourself up for the next phase of whatever your plan happens to be.

For my partner and I that means moving abroad with our eyes on buying a small apartment to live in or buying an income property to cover our rent and then some. Even if we move and start out renting, we’ll continue to save to buy a place to live in or rent out.

In all of the above scenarios, we will have lowered our cost of living—overall and on housing—by a meaningful amount. Even starting from our present, relatively low cost of living in Los Angeles.

Hiking Griffith Park in a suddenly green Los Angeles last weekend

As promised, here’s the plan for February and March—

As you might know, my partner and I will spend February in Spain and Italy.

The itinerary—Barcelona, Valencia, Madrid, Rome, Naples, Barcelona

For the month of February, I’m currently planning a month-long series of 20 Never Retire newsletter posts in 28 days.

Each post will include the following (in no particular order)—

Photography from the cities we visit.

Thoughts, observations, highlights from the cities we visit.

A breakdown of what we spent each day to compare the cost of living in Spain and Italy to the United States and elsewhere.

A Never Retire checklist item. A total of 20 practical money/work/life-related boxes you need to check to live the semi-retired life you wanna live now and for the duration.

Then, in March, I’ll do 20 posts in 31 days, meticulously detailing each of the 20 items.

Life behind the paywall here is great. Really looking forward to the coming posts from abroad.

We've been incredibly lucky with our three homes -- starting with a refurbished crack apartment in Seattle back in the early 90s. That went up enough that we were able to eventually buy a somewhat better place in the more affordable Tacoma area. And that in turn allowed us to finally buy a much nicer house in a much nicer neighborhood in Seattle, which we sold six years ago when we became nomads.

We're finally talking about maybe buying a place, but it will definitely be in an affordable part of Spain or Italy. Have no intention of being house rich/life poor.