Never Retire - The Biggest Mistake I Ever Made With Money (Other Than The Obvious Ones)

Originally, I was going to write a short post with a resource I thought you might find useful pursuant to this morning’s installment.

Then, I got carried away. So we’ll save the resource for the end and tie the carried away part to it.

I’ve made three big money mistakes in my life.

The first two are the obvious ones, though I don’t regret them.

The last one—not so obvious. And I think I kinda sorta regret it.

#1—Getting into debt in my twenties and thirties.

The best part of using credit to finance life, then getting into trouble is you learn from it.

At least I did.

My experience with debt early in life laid the groundwork for my philosophy with money today, particularly a low cost of living.

#2—Not giving up on traditional retirement sooner.

Maybe it’s not so obvious. Though, if you read this newsletter, it probably is.

For a whole host of reasons we’ve discussed here, when I saw the writing on the wall that I’d Never Retire, I resisted. I stayed the traditional retirement course. I doubled down on working and investing. I became miserable.

I regret it because embracing the reality that I’ll Never Retire was the best thing I ever did. I wish I had done it sooner. I wished I had viewed it as a positive sooner.

Because I would have started living the semi-retired life earlier and focused on personal financial strategies that actually work for me. Not the carbon copy ones the retirement industry prescribes for the masses.

Here again—lesson learned.

#3—Not buying an income property.

If this isn’t an outright regret, it borders on one.

Coincidentally, after writing this morning’s installment, I saw some interesting data on how much housing prices appreciated between 2011 and 2021.

Of course, the numbers are insane.

The cool thing about this study is it shows how much homeowners in different metro areas made, on average, per day between 2011 and 2021.

Of course, you don’t make anything until you sell. And even then. But you catch the drift.

The San Jose metro topped the list at $266 per day. San Francisco came in second at $206. And, while down the list, the part of the country where I was born and grew up, Buffalo-Niagara Falls, came in #132 at a still impressive $23 per day.

Housing prices there appreciated 76% between 2011 and 2021 from $119,200 to $209,900.

However, the area I know best and write about often (including this morning)—Buffalo’s Westside—certainly comes in with much more impressive numbers.

In fact, the key neighborhood there—Elmwood Village—is more expensive than roughly 45% and 67% of the neighborhoods in New York State and the US, respectively.

I actually don’t regret missing out on the appreciation.

Sure, it caught my eye, but it merely got me thinking about my current focus on making my housing payment as low as possible and eventually eliminating it.

Around 2010, I thought long and hard about buying an income property in Buffalo. At the time, I could have easily afforded it. That ship has sailed. Which is fine. Priorities change and now there are new, exciting tasks at hand.

However, had I bought something there then to rent out, I would have been covering my rent with that income for all of these years, giving me exponentially more options as my partner and I enter relative old age and make plans to move to Spain (or Italy).

You win some. You lose some!

Though, you never really lose.

Borderline regret only because it’s part of what contributed to getting me to where I am now in life. And there’s no place I’d rather be than in my present position planning for an exciting future.

That said—if you’re in a position to buy an income property, it can be the cornerstone of any money meets life stragegy, particularly one where you’ll Never Retire.

If it makes sense for you.

If and when my partner and I do it it will be in Spain or Italy. And it will make sense for us. Whatever we do with housing in this next phase will lower or virtually eliminate our housing payment putting us in a better personal financial position than we were prior.

That’s my golden rule of housing.

As I’ve written here, you can do likewise in the United States, even amid these crazy real estate prices.

To this end, I came across a great resource—The Rental Wire. If you subscribe to receive emails from them—for free—they’ll send you attractive, single-family income property opportunities.

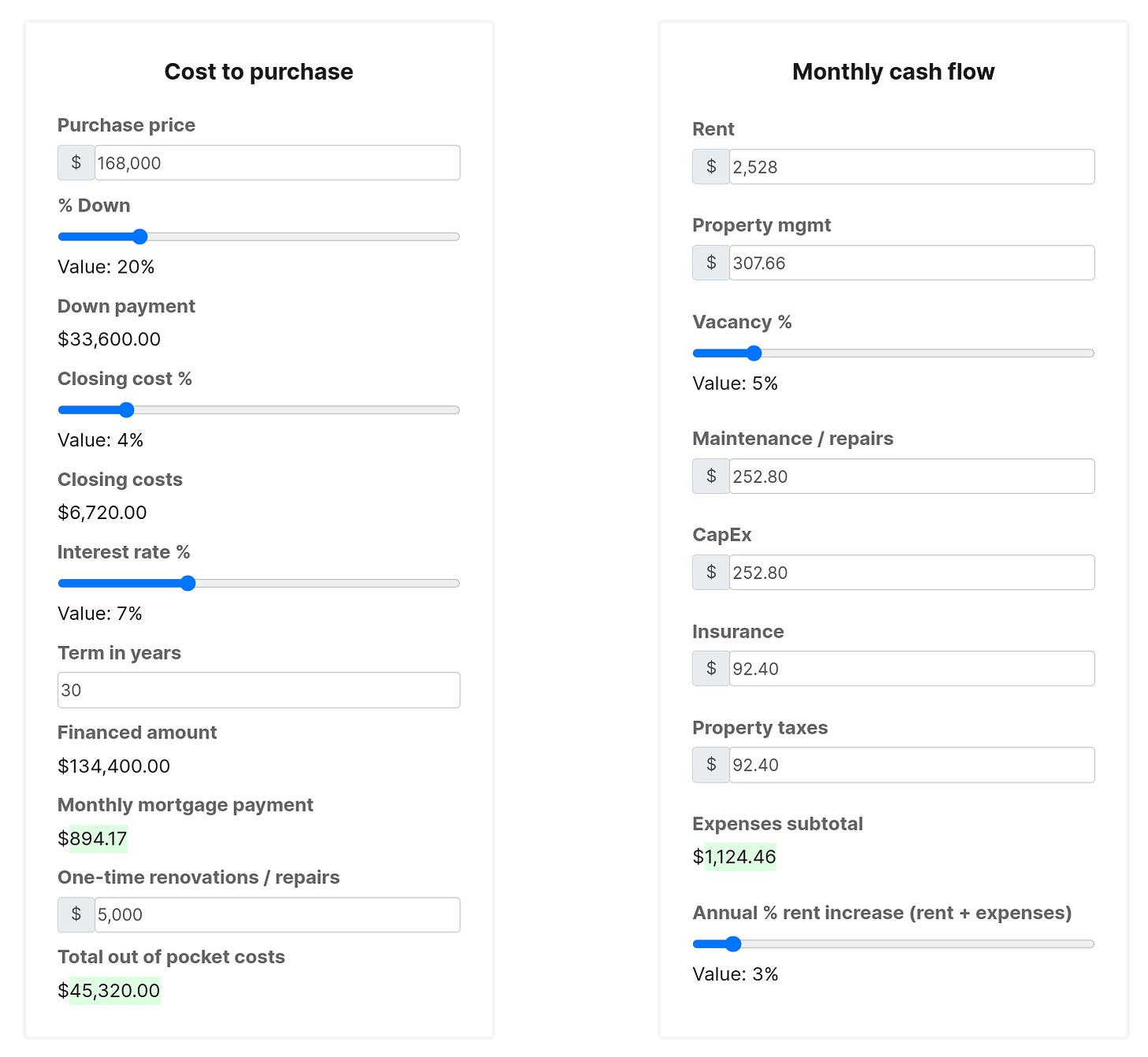

They have a great tool that lets you run the numbers on each opportunity—

They’re not paying me to pass long their info.

I just came across this functionality after writing about the Buffalo opportunity I highlighted earlier.