Never Retire - Question #2 for 2023: Why Do You Hate Budgeting?

And a FLASH SALE on annual newsletter subscriptions

Why do you hate budgeting?

Based on some of the things I write in the Never Retire newsletter and on Medium, readers sometimes ask this question.

The short answer—I hate budgeting for me, but not necessarily for you. Only you can decide how to structure your personal finance. While forms of traditional budgeting work well for lots of people, I also assume quite a few people—like me—would be better off using an alternative.

I’ll expand this line of thought in a second, but first…

FLASH flooding made me decide to do a FLASH sale!

Now through Friday, you can subscribe to the Never Retire newsletter for half the price on an annual plan. So $50 becomes $25 for your first year. It’s a good time to subscribe ahead of our plans for February and March, which I summarize at the end of this post. A majority of the February and March posts will go behind Substack’s paywall.

Back to budgeting…

I don’t like budgeting for two reasons. One general, the other specific.

Specifically, I am a freelancer. Though I do a decent job of keeping it relatively steady, my income can fluctuate. So I can’t count on pie chart budgeting, which allocates a percentage of your income to each expense each month.

Generally, standard budgeting focuses on spending, not cost of living.

If I make $5,000 a month, standard budgeting tells me I’m good to drop up to $1,500 on housing. This follows the principle of not spending more than 30% of your income on housing.

Here’s the reality—

More than 40% of renter households spend more than 30% of their income on housing.

The percentage of homeowners who spend more than 40% on housing nearly doubled between 2019 and 2022, going from 16% to 29%.

Why is this the case?

Any number of reasons, ranging from—

It’s just expensive where you want to live.

You have bitten off more than you can chew.

Your income decreased since you signed your lease or took on your mortgage.

Or, you somehow justified overspending on housing, rationalizing it by saying you’ll spend less in one category (maybe going out to eat and drink) so you can spend more in another. This plan almost always fails. Like New Year’s resolutions.

Quite often couples run this type of math. I make X. You make Y. Each of us can afford X for housing. Double that number and we can get a killer place for $3,000, $4,000 or maybe more thousand a month! If we go over by a couple to a few hundred, it’ll be easy to make it up between the two of us.

These are all examples of potential budget pitfalls.

When you don’t budget and focus on cost of living, it’s a much different picture.

My girlfriend and I are a good example.

I tell the story often of how before we even knew one another we made the solo choices to keep our housing costs as low as possible. Then, we met. After nearly two years, we moved in together. Splitting the rent on her place keeps each of our monthly housing expenditures at $702. Neither of us saw the sense in combining forces and renting a $3,000 or $4,000 apartment.

It’s for this reason that (a) I don’t need to budget and (b) we can spend a month (next month) in Spain and Italy. Because we keep the big, fixed expenses low, allowing for ample free cash flow for discretionary spending and near- and long-term savings.

Speaking of February and March, I’ll take this subject even further with even more concrete examples of how you can set yourself up to not budget and why budgeting isn’t always a great idea in the first place, particularly if you make decent or better money.

So, here’s what’s coming up in the next two months—

As you might know, my partner and I will spend February in Spain and Italy.

The itinerary—Barcelona, Valencia, Madrid, Rome, Naples, Barcelona

For the month of February, I’m currently planning a month-long series of 20 Never Retire newsletter posts in 28 days.

Each post will include the following (in no particular order)—

Photography from the cities we visit.

Thoughts, observations, highlights from the cities we visit.

A breakdown of what we spent each day to compare the cost of living in Spain and Italy to the United States and elsewhere.

A Never Retire checklist item. A total of 20 practical money/work/life-related boxes you need to check to live the semi-retired life you wanna live now and for the duration.

Then, in March, I’ll do 20 posts in 31 days, meticulously detailing each of the 20 items.

Today, I leave you with this.

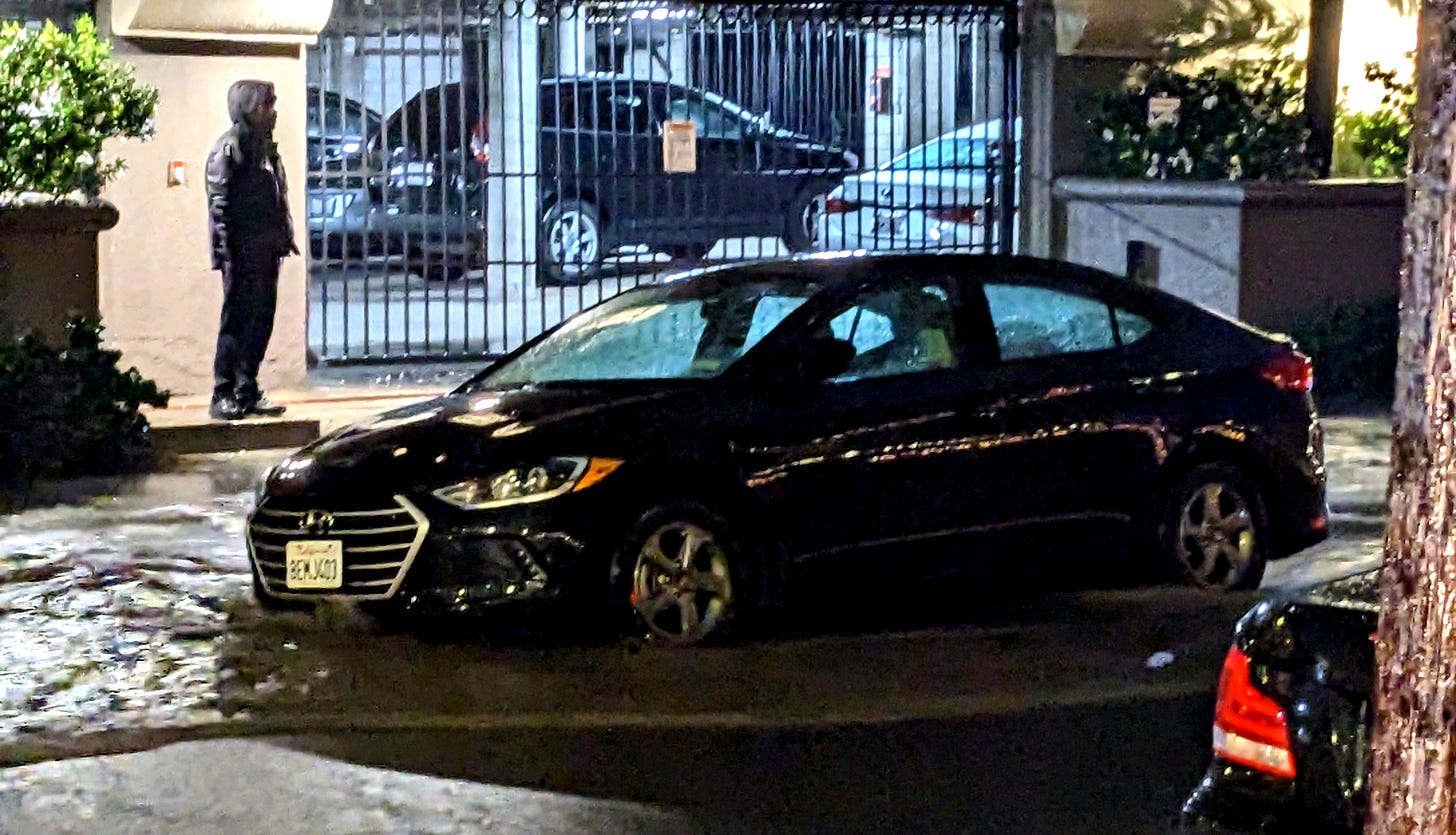

We had a nice little flash flood in our neighborhood this week. (I live in Los Angeles). Here’s a picture of my car, which came out unscathed. Can’t say the same for some of our neighbors who experienced major flooding on the street and in parking garages. As I write tomorrow on Medium, I can’t wait to get rid of my car! It’s a money pit!

Just finished creating my budget for the year 2023. My first full year of retirement...so it's a new experience for me. A bit scary to see the projected expenses versus the low income and the big shortfall...which means I have to dip into my retirement savings. But then that was always the plan, so it's all good.

Now that I have a budget and a cashflow projection, I know what to expect and can plan for it proactively.

Just discovered your Substack and am intrigued as the financial strategies you seem to be discussing are very much line with how we now live our lives as digital nomads. I'm currently 59 and my husband and are both writers, and except for one fourteen month period, I haven't held a regular job since I turned fifty, but have done a variety of different things, including now running our Substack about our lives on the road.