Never Retire - Cash Security, Period.

If you fell or are falling short of saving $1 million or more

Cash security resonates big time with many of us who will Never Retire.

Probably because when we first started thinking about and actually saving money—I was a teenager—we set our sights on that magic nest number: $1,000,000. The amount of money that would facilitate quitting work altogether so we could retire traditionally.

Life happened. Reality set in. We realized we weren’t gonna get there. We freaked out.

So we entered the same numbers in a retirement calculator and doubled down on a strategy that simply wasn’t going to suddenly start working.

Many of us did this for two reasons:

That’s what the experts strongly suggested we do.

We felt like we had failed. So we wanted redemption.

Turns out redemption could never come unless we adopted and embraced an alternative strategy to money and, for a large number of us, life.

I don’t know where you are in your Never Retire journey. Or if you’re even on one.

If you are, I assume realizing you fell short—maybe even significantly short—of a million bucks spooked you.

It did me.

However, when you’re going through it, you don’t realize how everything’s connected.

You were attempting to save this out-sized lump sum of cash at the same time as:

You were situating yourself to buy a house or maybe already servicing a mortgage and the attendant costs of home ownership.

You were driving an expensive car.

You were working a 9-to-5 job that left little time for much else. For fun.

And so on.

As always, you’ll tweak this story to fit your unique circumstances. But let’s just assume I’m in the narrative ballpark, specifically as it pertains to cash security.

Much of what we’re told and, subsequently, think we should do with money jeopardizes our cash security.

The house—you’re building equity instead of throwing money away on rent.

The car—you work hard. You deserve it. You should be able to have nice things.

The job—you’re lucky to have it. Be grateful. It gives you this life.

At the same time as you’re trying to save for retirement.

Think about that.

You’re doing all of these things with money, all at once. If you’re of modest means, it’s a house of cards. So the retirement crisis we keep hearing about comes as no surprise.

We’re asked to do the impossible (for many of us) to secure traditional retirement.

Why was this the norm for so long?

Thankfully, new ways of organizing work and money around life (not the other way around) have emerged and appear to be taking over.

Soon, your homeowner friends (or aspiring homeowner friends) will stop asking when are you going to buy something? So annoying. They’ll understand your need for cash security.

Because—using my personal finance—it looks a little something like this if you’ve fallen short of $1 million and embraced the reality that you’ll Never Retire.

Up until last month, I was paying $1,342 a month to rent a small studio apartment in Los Angeles’s urban core.

This month, my girlfriend and I moved in together—just up the street—where we split the rent on her one-bedroom apartment. I’m on the hook for $702 a month.

Both examples scream cash security. I’d have it no other way.

Consider my/our other options.

Rent a new space. Our space! We could have done what many other couples do when they move in together. Leased a new apartment. A larger space maybe for a home office, an extra bathroom, more closet space, or the age old we just wanted our place to be our place.

To do this—right now, in Los Angeles—it would cost a minimum of $2,500, probably closer to $3,000. Split the difference and call it $2,750. We would be paying $1,375 a month each.

Could we afford it? Yes. Would it impact our lifestyle? Also, yes. More importantly, would it mess with our cash security? Absolutely.

Buy a house. We’re enterting personal financial fairy tale land here, but let’s humor one another.

Let’s say we found something for $1,000,000. Unlikely, especially in an equivalent neighborhood, but, again, we’re humoring one another.

We’ll even ignore that this property would likely be a condo with a potentially hefty HOA fee.

We’ll also disregard the ultimate blow to cash security—that we would have to come up with between $100,000 and $200,000 for a down payment to secure the right to commence a 30-year mortgage. I can’t help but laugh just reading that last sentence.

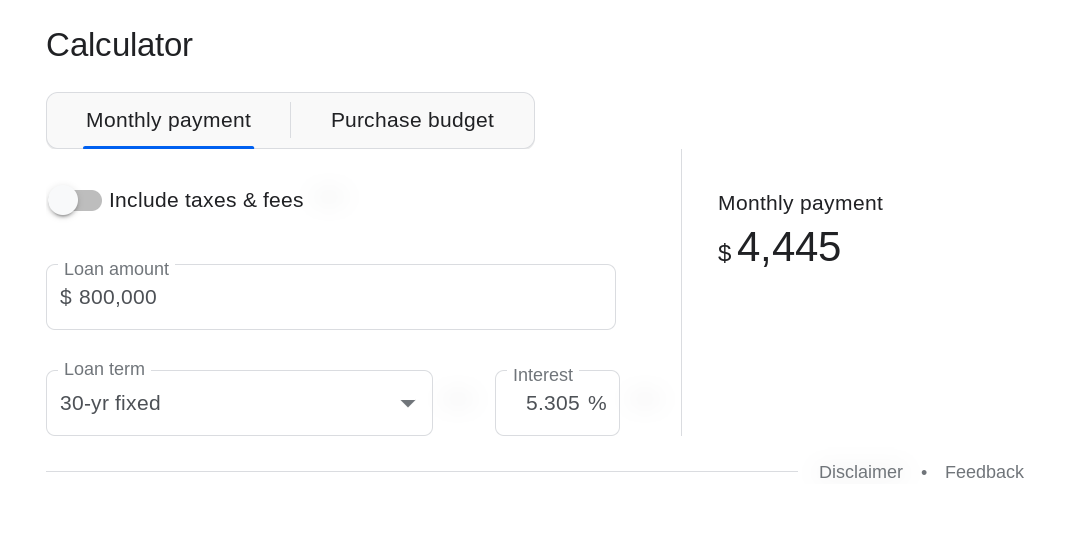

A 30-year mortgage that’d look a little something like this—

$4,445 a month.

Tack on property tax of roughly $1,000 a month and, without considering any of the other costs of home ownership, we’re at $5,445 a month for housing. $2,722.50 each.

We would have increased our housing expense by at least $2,020.50 apiece.

I don’t care about home equity or any other argument in favor of making this move. Nothing matters more than having the cash security of an extra $2,000 a month, per person, or not having to work that much harder to secure another $2,000 a month, per person, to live this so-called dream.

Nothing matters more than being able to work less now so we can work less longer.

There’s nothing scarier than having to pay that amount of money, every single month, until I’m freaking 77 years old.

Nothing matters more than cash security.

As I noted in my recent Medium article, I’m not opposed to buying property. It just has to make financial sense.

It would have to enhance cash security, not effectively destroy it.

One of the additions I brought in to my girlfriend’s (our) apartment—the great Tom & Jerry