In today’s installment of the Never Retire newsletter, we hit three of our biggest topics in one post: working longer, investing, and travel.

If you’re new to the newsletter or thinking about subscribing, consider this a nice introduction. If not, it’s a continuation of what we’ve been doing the last 9+ months.

While day-to-day and long-term personal finance strategies sit at the heart of any Never Retire situation, offshoots apply.

Most definitely—working longer. Most likely—investing (or saving). Probably—traveling.

Working Longer

We often review research articles dealing with Never Retire subject matter, particularly semi-retirement and working longer/working in retirement.

I have a Google alert set up so I see the most recent academic work in the area when it comes out. I have a backlog of articles I plan on getting to over the next few weeks.

Earlier this week I received an alert for a forthcoming book by two Harvard professors called, Overtime: America's Aging Workforce and the Future of Working Longer. I pre-ordered it on Amazon. You can do likewise. Maybe we’ll start a book club :-)

It’s great to see the subject getting nuanced consideration.

While the book will focus “on the challenges faced by traditionally marginalized social groups” (which is great), it appears to have broad appeal.

I highlighted two blurbs that deal directly with the stuff we regularly discuss here:

(The authors) argue that policies affecting work must be considered alongside policies affecting retirement and provide a path forward to achieve better retirement security for all Americans.

Exactly.

As we recently discussed, typical government policy on retirement does little to address the changing nature of retirement for increasingly large swaths of the population.

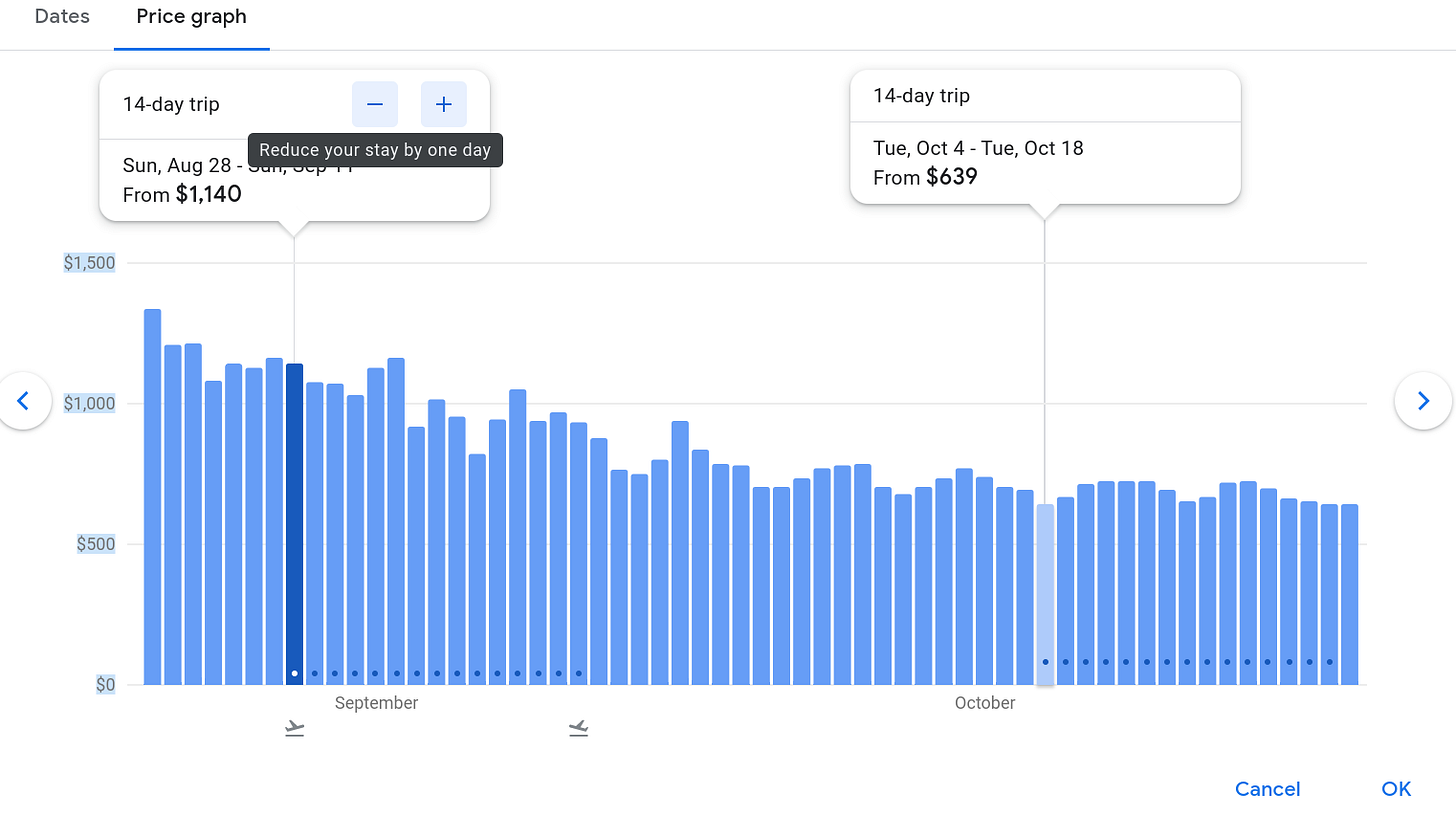

The other section that caught my eye comes from a chapter called The Psychology of Working Longer:

Totally speaks to me, and, quite possibly, you.

Other chapters from the book include:

Dying With Your Boots On: The Realities of Working Longer in Low-Wage Work

The European Context: Declining Health But Rising Labor Force Participation Among the Middle-Aged

Forecasting Employment of the Older Population

All of this pertains to our discussions, given that we focus so much on preparing now so you have choice in exactly how you’ll generate cash flow in relative old age and beyond.

Investing

We recently started a series on dividend growth investing as a possible Never Retire strategy.

Part One—Using Dividend Investments To Fund A Never Retire Strategy: A comprehensive guide to investing for 'passive' income

Part Two—The Best Way To Understand Dividend Stocks Is To Know Dividend Aristocrats

Consider this Part Three.

Using ETFs to create a dividend growth investing portfolio.

ETF stands for exchange-traded fund.

For most intents and purposes, ETFs function like mutual funds by owning a portfolio of stocks (or other assets) that track an index or aim to achieve a particular investing goal. The big difference—like stocks, you can buy and sell ETFs at any time. Mutual funds trade once a day with everybody getting the same closing price.

ETFs take the guesswork out of investing. You don’t have to pick individual stocks or try to own every name in an index.

For example, in part two, we discussed dividend aristocrats.

You don’t have to run out and buy all 65 of them individually. Instead, you can purchase an ETF that’s weighted to reflect the performance of the S&P 500 dividend aristocrats index.

It’s called the ProShares S&P 500 Dividend Aristocrats ETF (NOBL).

NOBL generally holds up well against and, recently, outperforms the broader S&P 500.

All types of dividend-focused ETFs exist. US-based, international, high yield, you name it.

Speaking of high-yield. Part Four of our dividend series goes out to paid subscribers later this month. In it, we dig deep into yield after defining and illustrating it a little bit in parts one and two.

In Part Four, we focus on why it’s so difficult—if not next to impossible—to achieve the yield necessary to fund your cost of living.

Consider this a preview: At the moment, NOBL yields 1.93%.

To keep it clean, round that number up to 2%.

If you have $100,000 invested in NOBL, it generates roughly (not counting for taxes, expenses, and such) $2,000 in annual income.

Most of us cannot live on $2,000 a year, even if we maintain a super low cost of living.

Obviously, to make it work you need a lot more money invested, a much higher yield, or a mix of both. We dissect this in Part Four.

Traveling

In Part One of our series on travel, we explained how to save by traveling internationally rather domestically. The former can be much less expensive. We opened that installment with the rationale around why we include travel prominently in the Never Retire newsletter:

Many of us who will Never Retire embrace this reality out of choice and necessity.

At some point, the writing on the wall became clear enough for us to know we were not on track to save enough money to fund traditional retirement.

So we had a choice—

Do what most money experts suggest and try to save more to salvage the situation.

-or-

Conclude that the work/retire/die path to traditional retirement wasn’t for us after all and chart a different course.

This different course almost always includes a low cost of living (finding the floor), keeping your housing costs as low as possible, setting yourself up to do suitable work in retirement, and working less now so you can work less longer.

You work less now so you can work longer, in part, because you want to do things like take time off (minutes every hour, hours every day, days every month, and weeks and months every year) and travel frequently and maybe somewhat extensively.

However, if, like me, you simply make decent or better money—you’re of modest means—you have to manage your money strategically and make sound spending choices to live this semi-retired life now and for the duration.

If this description looks and sounds exactly or a lot like you, there’s a good chance you want to travel as much as possible now. And you want to travel more and more as you age.

It’s one of the main reasons to work less—to preserve your physical and mental health so you have the capacity to enjoy life through traveling or whatever else you like to do.

In, Part Two, we discussed a great flight deal service, Scott’s Cheap Flights, and the #1 tip Scott has for booking trips.

Today, another quick and easy hack. Use Google Flights to search.

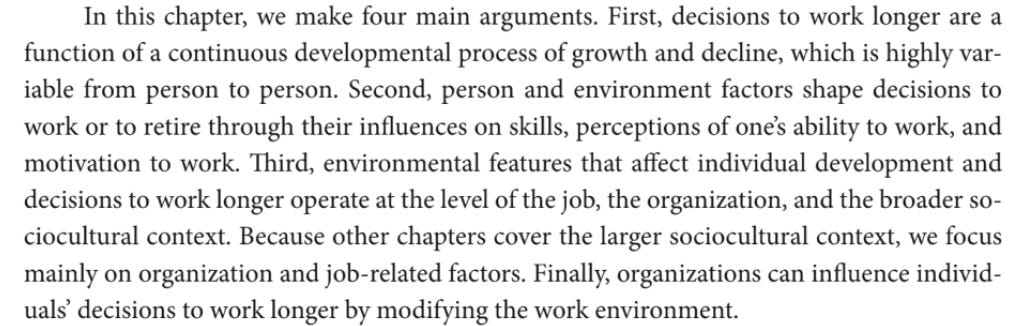

The best Google Flights feature is how it breaks down prices—by day and by length of trip—when you search dates.

Using LAX to Barcelona, a flight my girlfriend and I will take early year, as the example:

At the moment, the sub-$500 deal we received for February/2023 is gone:

However, it’ll come back. Scott’s will certainly send an email when it does. Or you can ask Google to alert you to price changes for any number of routes:

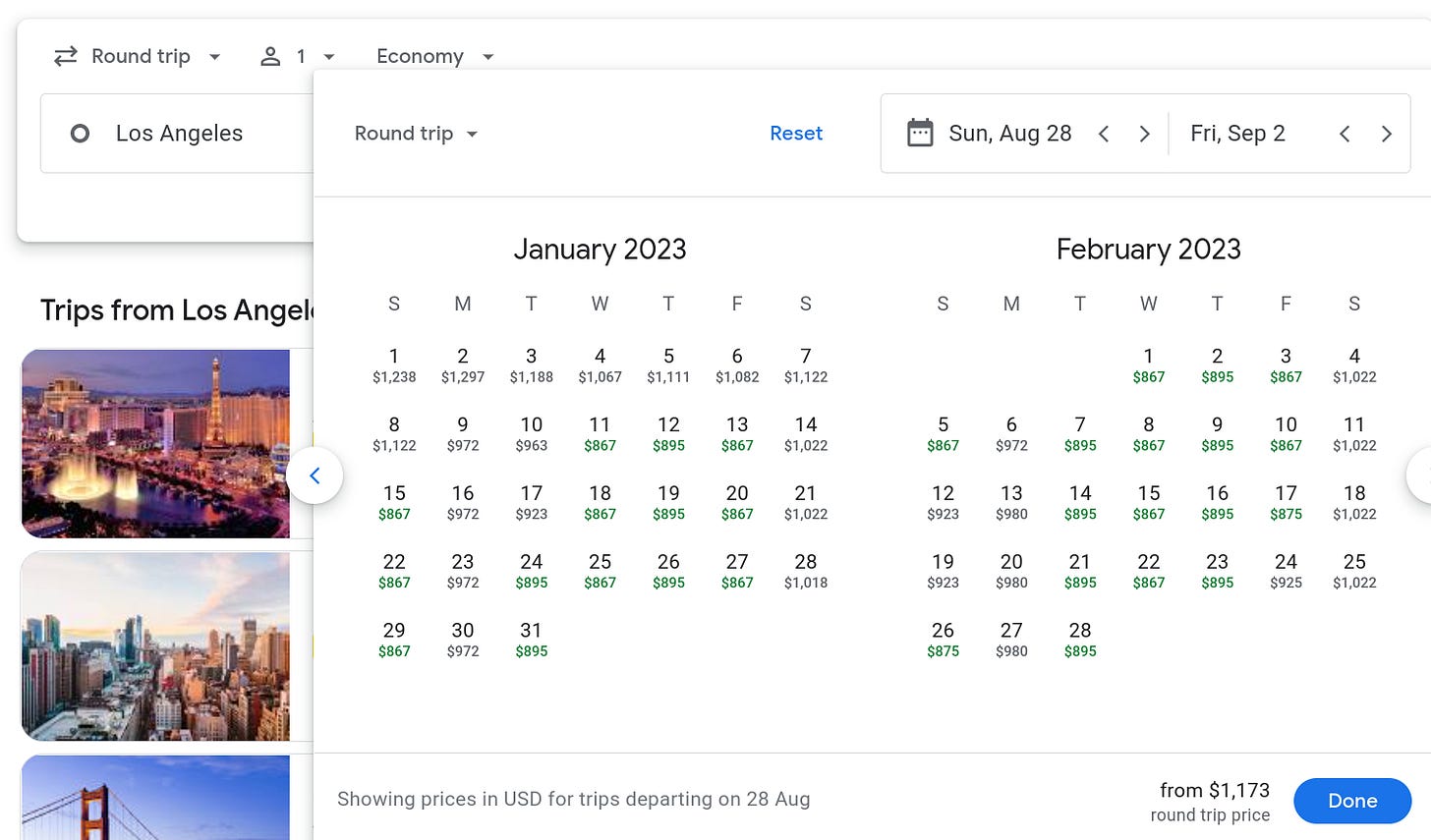

Google’s price graph is also super helpful to visualize price fluctuations by day and based on the proposed length of your journey.

That’s it for today.

We’ll continue these series and hit our bread butter hard—core personal finance to help craft your Never Retire strategy—in the weeks and months ahead.

Please consider subscribing today. And have a great weekend.

I leave you with the scene outside Bar San Calisto in Rome earlier this year. Can’t wait to go back!

Oh boy! A book club!! 😀