Living The Semi-Retired Life: I Hesitate To Say This, But...

In the most recent edition of the Living The Semi-Retired Life newsletter, I said:

I hesitate to say this, but I think there’s some truth to it.

If you can’t handle rent increases, there might other things wrong in your personal financial situation.

This came amid speculation that my landlord might raise the rent.

As I noted in that post, rent increases don’t concern me much. Of course, I don’t like them. However, in my 28 years of renting I have only experienced a rent increase four or five times. Lots of people who say you’re throwing money away on rent use the prospect of landlords raising the rent as a scare tactic. They overstate the frequency and magnitude of the rent increases renters apparently face at the individual level.

Anyhow, the conversation got me thinking about a, say, $150 rent increase as little more than a rounding error in your personal finance.

I hesitated to say that because for many people—through no fault of their own—an extra $150 a month as a fixed expense absolutely matters.

It’s beyond the scope of this newsletter to get into why and how this subset of the population struggles to make ends meet.

I touch on this issue—of exactly who the audience is for most personal finance articles—in a story I wrote on Medium a whole 16 or so months ago:

It can be difficult to come to terms with, but if you write and/or read money articles on a regular basis, you’re attentive to that sweet spot of the population who, relatively speaking, have good problems to have.

If we share anything in common money-wise, it’s that we’re all simply trying to maximize our cash flow.

I don’t preach and maintain a low cost of living because I have to. I do it because it helps the money I make take me further.

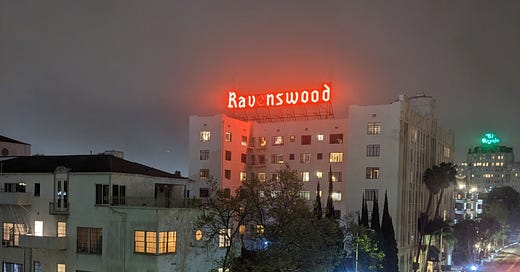

I could afford a $2,000 or $2,500 a month apartment and/or a $600 car payment on that Audi, but I choose not to go that route because it would be adverse to my financial present and future. In other words, that $1,000-$1,500 I don’t spend on housing and transportation each month gives me wiggle room for discretionary spending and saving and reduces stress in the months where I fall short on cash flow.

I don’t want to have the stress of meeting fixed expenses I don’t absolutely need to have. So the choice between $1,342 for rent and $2,500 for rent is abundantly clear to me. But, here again, it’s a choice.

Having choice is luxurious, if not privileged.

So, it is absolutely within our purview to consider $150 here and $150 there for those of us making decent or better money. Because so much of what we talk about deals with how to absorb $150 here and $150 there without even thinking about it, particularly for those of us who will Never Retire.

It comes down to organizing things in a way that makes that $150 (or whatever additional fixed or one-off expense you take on via force or by choice) inconsequential. While making more money almost always helps, we deal in how to do more as a person of modest means who doesn’t want to work 40-plus hours a week.

With this as the backdrop, a few things I hesitate to say about money…