Living The Semi-Retired Life: Here's How I'm Saving My Money This Month Compared To The Filthy Rich

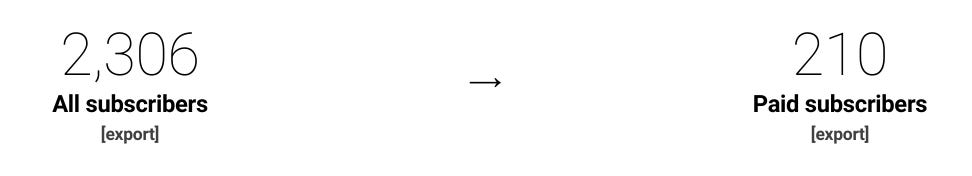

I have a goal to hit 400 paid subscribers by the end of this year. To help achieve this, I’m running my last promotion of 2023 through the end of May.

For the rest of the month, you can get a paid subscription to the Living The Semi-Retired Life newsletter—monthly or annual—for 25% off for 12 months. That’s either $3.75 a month or $37.50 for one year.

To secure this deal, simply follow this link.

Like always, you can join as a founding member, pay once and get converted to a lifetime subscription at no additional cost.

As I noted earlier this year, if you don’t hear from me for more than a week, I’m probably dead. Because I plan on writing this newsletter until I die, cultivating it into my main—and potentially—only source of income as I prepare to enter relative old age. Relative old age that includes—if all goes as planned—a move with my partner to Spain.

With a subscription to the newsletter, you can follow us on this journey. You’ll also have access to all of the other content (financial, retirement-specific, travel and otherwise) as well as stories, thoughts and ideas other subscribers contribute via comments, Substack Notes, Substack Chat and guest posts.

With that said, something I think about from time to time.

People like to see illustrations of how much money rich people have. Or just people who have a lot more money than they do, even if they’re not technically rich.

We usually access this information via social media and stories about expensive real estate being bought and sold. Within a few blocks of where my girlfriend and I rent a below market rate Los Angeles apartment, celebrities (and people you and I have likely never heard of) routinely make multi-million dollar real estate transactions.

It’s another world. Right out my front door.

An even better way to gawk at obscene wealth on display is to pull up insider transactions for publicly-traded companies. That is stock bought and sold, most often via exercised stock options.

Doing this can make you feel financially small when you make the mistake of comparing it to your spending decisions and how much you’re able to save on a regular basis.

For example—