Living The Semi-Retired Life: An Inspiring Semi-Retirement Story

It's never too late (though it's great to start early!)

Through the end of the month, get 25% off monthly ($3.75) and annual ($37.50) subscriptions to the Living The Semi-Retired Life newsletter for 12 months. This is the last promotion I’ll run in 2023.

Your support helps keep the newsletter running till the day I die (true story and I’ll be 48 in July so I’m planning on at least 52 more years!) and gets you access to everything we do on money, retirement, semi-retirement, working in retirement, health, my plans to move to Spain, travel and more.

Guest posts are always free.

Like today’s guest post by Gary Foster, an executive recruiter, retirement and career transition coach, who writes the excellent blog, Make Aging Work.

Gary and I found each other’s work several months ago. I like what he does so much that I asked him to write a guest post for the newsletter.

I know it’s not nice to talk about age, but it’s critically important to the story.

Gary is well beyond traditional retirement age. Given that he has a good 30 years on me, he can talk about his journey as a semi-retired person—still working and thriving—in a way I simply can’t. At least not yet!

So, please follow Gary’s blog at the link above (you can subscribe to receive emails from him at the bottom of the page) and enjoy his informative and inspiring story.

My journey with retirement has been akin to a wrestling match.

It took until my 70’s before I fully pinned it to the mat.

Retirement is not a part of my life plan. Never will be.

This will help you understand that mutinous position.

Growing up where retirement wasn’t.

I’m a product of rural, agricultural southeastern Wyoming. My formative years, in the 50s, were spent in a hometown of 600 people and a junior high and high school with less than 100 kids. The adult population was farmers, ranchers, and business owners that supported both.

There were no corporations to be part of. It was a near total entrepreneurial environment with a strong purpose behind each choice of profession – mostly survival.

I don’t recall ever hearing a conversation about retirement amongst adults. Generally, people worked until they couldn’t and spent the final years under the care of their family.

No old-people warehouses.

Whipsawing through the ‘80s and ‘90s

I was the first and only member of my family to get a college degree. I did what you did back then – get a degree, get a job, get a wife, house, fenced yard, 2 kids and a golden retriever.

I immersed myself heavily in the self-development movement in the early ‘80s – I’ll call it the Earl Nightingale, Napoleon Hill, Dennis Waitley, Brian Tracy, Zig Ziglar era. Lots of books, tapes, and live seminars. Those roots still anchor me today in terms of understanding human development and achieving one’s unique potential.

As I studied, one observation was that most of the high achievers on the planet didn’t abandon the creative process. They stayed in that process to the end. Retirement wasn’t a consideration for most.

During that time, my beloved father-in-law died suddenly 10 months from his retirement after 45 years with the same oil company as a successful petroleum engineer and executive leader. He had just been given a clean bill of health by his physician but succumbed to a massive heart attack as he slept.

I recall how uncomfortable he seemed after his retirement – he seemed to drift. There just wasn’t the same sense of purpose that he had in his successful, extended career. He missed the work challenge and the relationships.

My doubts about the logic of a traditional retirement were further reinforced when, in 1995, the Social Security System revealed that the average number of Social Security checks issued was under 30. Retirement didn’t seem to be a great plan for extended longevity.

The internet boom nearly changed my thinking.

I confess to getting caught up in the early retirement craze that set in during the late 80s into the 90s, fueled by the insanity of the internet boom and the accompanying stock market explosion. As my 401K grew steadily, taking me to near millionaire status, I admit to dreaming of checking out, buying a Maserati, and a second home in the mountains to support a lifestyle of flyfishing and golf.

Then the wheels came off – all of them. The stock market crashed. My company (a telecom company) headed for bankruptcy, and I faced a forced retirement from my employer of 17 years. I seized the early-retirement package at age 60 and chose to feed my entrepreneurial leanings by bootstrapping my own business – a solopreneur venture as a healthcare recruiter.

My now-halved 401K continued to deteriorate with subsequent market corrections and a draw down to support the start of my new venture.

Coming face-to-face with my essence.

Full-stop retirement as a goal continued to fade further and further away, logically as well as financially.

My entrepreneurial venture taught me several things. Two key discoveries:

My 35+ years of corporate experience did little to prepare me for starting my own business.

I had failed, for most of 60 years, to acknowledge and appreciate my true essence and talents in favor of fitting the 20th century linear-life model and meeting prevailing cultural expectations.

My recruiting business was only moderately successful as I wasn’t a fan of the hunt for contracts with healthcare organizations. But what I did enjoy was engaging professional who were in career or life transition. It felt natural – and I was effective in being a guide for these people as a coach.

As I moved into my 70s, I became increasingly aware of what lit me up, got me excited about getting up in the morning. It all centered around writing, teaching, and coaching.

At 75, I moved my business in a direction that supported those skills. I started a weekly blog. I shifted my business more toward coaching. I obtained a national certification as a résumé writer and online presence strategist.

Today, I enjoy a growing business engaging C-suite healthcare executives and physician executives to develop their career document portfolios and provide career transition coaching. It engages my love for coaching, deepens my writing skills, and generates a steady, comfortable income stream.

A Lifetime, Lifestyle Business

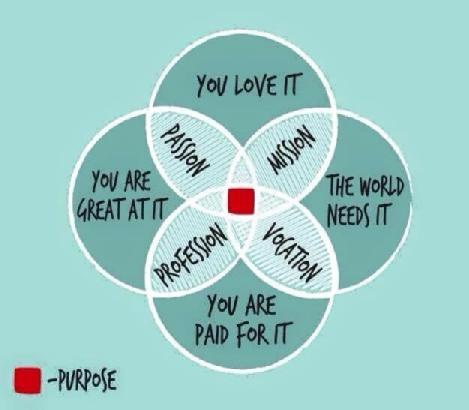

I consider it a business that checks all the “living with a purpose” boxes. Or, as is so popular these days, it meets the Japanese term for “life purpose” – ikigai.

I consider myself semi-retired with a lifestyle built on balancing labor, leisure, and learning. I have a business doing what I like and what I’m good at, that brings value to others, and I’m getting paid for it.

I can enjoy the lifestyle I want for my lifetime with no pressure to meet cultural expectations – as in “why haven’t you retired?”

In my mind, it’s validated that the traditional retirement model most people still pursue has more downsides than upsides.

We now know that work with a purpose is a key component of longevity. We are wired to grow and move. Retirement calls for the opposite.

Time for a never-retire model

If I could have a conversation with my 20-year old self, I would suggest ignoring cultural expectations, abandoning the 20th century linear-life-model (learn-earn-adjourn-die), figuring out, acknowledging, and refining your deepest talents and dreams and start now to build a lifetime, lifestyle business around those talents and yearnings. Don’t let the archaic, illogical, and unnatural concept of retirement creep into your thinking. Keep your overhead low and your cash flow steady.

Balance your life across labor, leisure, and learning.

Above all, don’t wait until your 70s to figure all that out.

“Balance your life across labor, leisure, and learning.” 🔑

I focused especially on the last paragraph. I have recently gone from a 39 year 'career' to a series of 'jobs'. The financial services industry isn't kind to those of us over fifty. The onset of grey hair sets off a silent alarm if you aren't a CEO or similar on Wall Street. My passion is music and all the back stories of the artists and songs from the 60's, 70's and some 80's. I would tell my twenty year old self to not concern myself with what everyone else was doing professionally and take more chances. And to ask Lori Walchow out before I moved away from DC.!!