Today, we further break down the question of how do you know you’re ready—financially—to be semi-retired. Which might or might not include a move abroad.

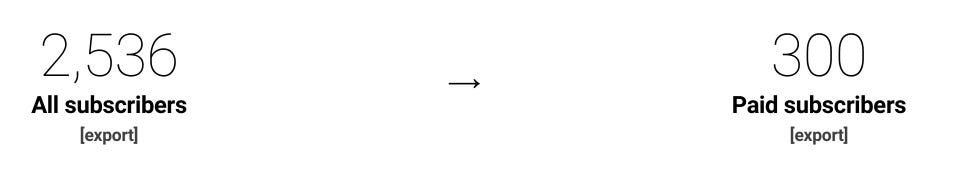

Big thanks to everyone who pays to subscribe to the Living The Semi-Retired Life newsletter. In just under two years, we have hit 300 paid subscribers.

My paid-to-free subscriber ratio is 11.8%. Why is it so high? Because I present Living The Semi-Retired Life as a paid subscriber newsletter. Without hesitation.

74% of the 300 paid subscribers have come in the last year.

This is because, over the last year, I have increasingly dedicated myself to writing this newsletter. I recently decided to stop writing money articles on Medium and will only publish them on Substack. My goal is to make this newsletter my sole source of income within the next 5-to-7 years.

As I love to say—I’m 48 years old. So you have a good 52 years worth of near-daily posts remaining. In just over a year, I have every intention of writing this newsletter from a terrace in Spain.

As that gets closer, I’ll detail every aspect of the moving process, from applying for a visa to initially renting and eventually buying an apartment in Spain. This alongside regular personal finance content that’s anything but regular. My goal—to help you make financial decisions not based on convention or consensus. Because, as we’ll discuss today in response to a reader question, convention or consensus doesn’t mean much when your psychology around money enters the picture.

I’d love for you to answer Jenna’s question in the comments, particularly if you have—

Made a move abroad.

Transitioned from full-time work to semi-retirement, but needed to seriously situate your finances prior to doing so.

Here are my two cents—